The Shopkeep Model of Investing

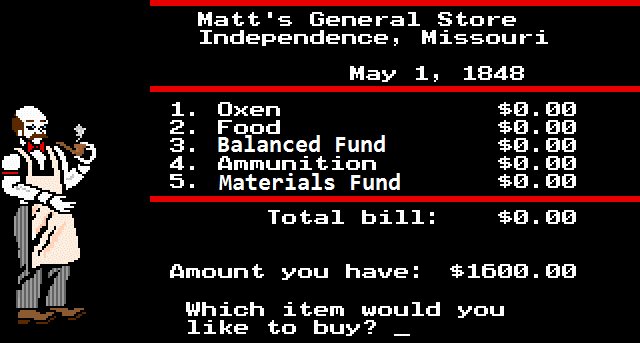

October 8th, 2014 by PotatoOne of the challenges I think people have with investing is that the actual purchasing part is quite unlike other aspects of our daily lives. We use metaphors like “fruits and baskets”, describing different accounts (RRSP, TFSA, etc.) as baskets where you place investments (cash, stocks, bonds, funds thereof) — but you can’t go down to your local general store and ask the shopkeep for a half dozen index funds off the back shelf to stick in your basket.

Even after you decide that you want to keep things simple and use a straightforward indexing approach, and you have to figured out what to buy to fit that plan, you have to figure out how to buy those investment products. The big barrier can come when you have to go and “buy an XIC.” There’s no counter you can walk up to and make that happen.

The investment industry is either full-service (with associated fees) or a completely do-it-yourself “wholesale/auction” experience. The high fees attached to many products are built in assuming that you will pay for planning, stock-picking, and other help even if you never get it and you’re only after someone to help you make the transaction. Many people are disappointed with the depth and quality of the advice they receive in a bank branch, and are surprised to find that the staff are in fact in a sales role. Whether satisfied with the advice or not (and in many cases one needs more background knowledge to know that they should be dissatisfied), I think many Canadians are shocked at the fees when put in context.

I think some Canadians do go into the bank not looking for advice, but for a shopkeep. So they’re not dissatisfied with advice because they never really expected any — they were just looking for help making a transaction. But again, the fees for that level of service are shocking.

I would have thought that with TD’s e-series there was enough of a MER there to let the branch staff help with placing orders — even if they were not allowed to spend time on e-series clients — but instead the e-series are completely off-limits to branch staff. There is no minimal-cost “purchase assistance” type service. The closest equivalent is Tangerine, which packages everything together for you so you just need to throw money at the account — it’s the closest implementation I’ve seen to how many people talk about “buying an RRSP.”

And that’s just mutual funds: with ETFs there are added levels of confusion for people expecting the shopkeep model. It is not at all like going in and picking up a cool book that your friend recommended from the shelf — it’s more like buying livestock at auction crossed with a old-time bazaar where everyone is selling everything to everyone else and the prices change by the second.

It would be interesting if someone could take a one-time commission (not an ongoing trailer fee forever and ever amen) to make that a more pleasant retail experience. Put up a list of prices that stay where you put them, and the shopkeep eats the fluctuations; or to make buying ETFs more like buying mutual funds where the division from the money you have to throw at the asset class happens automatically, and where no one gets burned by limit orders or the lack thereof. Getting back to reality, there’s no getting around having to learn this somewhat different (but once you get it, not difficult) way of purchasing investments.

Of course, to help people navigate on their own when there is no clerk to guide them is why I wrote The Value of Simple, and that implementation part forms the meaty middle of the book. Maybe one day more banks and fund companies will drop the pretense of offering high-cost advice and stock picking to every customer, and instead offer transaction assistance for low-cost index funds. Until that day comes, sign up below to receive updates on the book.

Questrade: ETFs are free to trade, and if you sign up with my link you'll get $50 cash back (must fund your account with at least $250 within 90 days).

Questrade: ETFs are free to trade, and if you sign up with my link you'll get $50 cash back (must fund your account with at least $250 within 90 days).  Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including sending you an email reminder when new cash arrives and is ready to be invested.

Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including sending you an email reminder when new cash arrives and is ready to be invested.

October 14th, 2014 at 3:09 pm

Maybe the arrival of robo-advisers will change this. It won’t be a one time fee as you suggest, but it seems as though the fees they charge (0.5%) plus the etf charge (average 0.2 to 0.25%) will be similar to banks index funds (average 0.7%) and just a bit more expensive than the e-series.

October 14th, 2014 at 10:26 pm

There’s hope with that model! Unfortunately I don’t know yet if the robo-advisors will survive. Just a few months ago Bortolotti had an article on how the model was impossible in Canada; as it is I don’t think any of them are available nationally because of the securities regulations. And now there seems to be a new one every week — I haven’t had any time to look into them at all… and I haven’t made it a priority because I don’t know which of them will survive. Though the underlying assets should be fine (market crashes notwithstanding), it’s not an area I want to be an early adopter in (or recommend others be the first to try).