The GTFO Calculator

July 18th, 2016 by PotatoI was stuck on the subway for a long time today. A really long, sweaty, stinky time. My commute this morning took two hours door-to-door thanks to numerous PAAs (Passenger Assistance Alarms — they happen so often they’re just referred to in acronym form) on the line. It’s a hot July day, and though the train is air conditioned, much of that time was spent loitering at various platforms with the doors wide open, sucking in the hot platform air (superheated by the A/C exhaust). It’s days like this that really drive home how much Toronto was not built for the enjoyment of its citizens.

Nelson had a post with a title that seemed targeted right at me today, explaining how much lower the cost of living is in small towns (mostly driven by the lower cost of housing), which is a great opportunity for teachers and other professions who get paid about the same amount no matter where they go (indeed, there is a surplus of new teachers in the big cities, while his local school has unfilled positions).

Comparing living in a small town to living in Toronto or Vancouver has a lot of subjective factors to consider, from amenities and attractions to salaries, job prospects, and the network effect. Indeed, I used to live in the virtual paradise of London, Ontario, which featured a modest cost-of-living, all the day-to-day amenities one could want, jobs within walking distance of livable communities, good curling, and all within a short drive of Toronto for weekend visits and the odd bit of ephemeral culture that wasn’t native to London. However, my family and Wayfare’s family live in Toronto, so — network effect at play — when we spawned we came back upstream to do so here in the GTA. Plus we both have graduate degrees and work in specialized fields, and we both make more in the GTA than we would have in London… though in London we might not have needed to make so much, possibly leaving more time for leisure and Blueberry.

Aside from my own situation, I see still more and more people pour into the GTA, and many of them do not have any particularly specialized jobs, family ties to the area, or difficult two-body problems to solve. Indeed, many are young and single, lamenting the costs of home ownership, and I’m left wondering: “Why are you in this city? GTFO!”

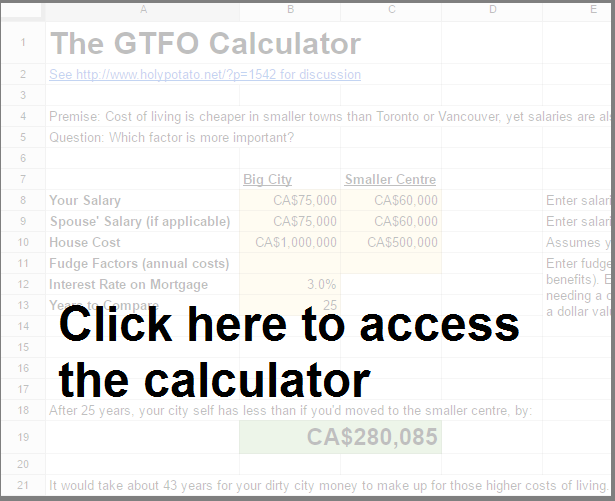

At what point does it make sense to take a paycut to move to a smaller city? At what point does a higher salary in a big city offset the higher costs of living? Enter the GTFO calculator.

Here you can enter your salary in the big city and a smaller centre, as well as the salary hit your spouse might have to take to follow you into fire, into storm, into darkness, or into Hamilton. Then you can enter the different housing costs and assume all else is equal to see approximately how much better off you’d be with the GTFO move — and how long it would take for your dirty city money to make up for the bubblicious living costs. There’s even a fudge factor cell for renters, or people who want to factor in having to get a 2nd car or whatever.

It’s set up as a Google Sheet with a protected range over where the magic happens, so you can just type right into the input range to get your answer instantly (a trick I copied from Sandi). So, how much more do you have to make to balance out the higher housing prices of Canada’s more expensive cities? Find out for yourself now!

Forced insight: you may find that seemingly large paycuts are still worth it (in a financial sense at least) because of how very expensive Toronto/Vancouver houses are now. It takes a lot of years — likely more than you have — making an extra $10-30k to outpace an extra half a million in mortgage debt.

Quibble: I didn’t (and don’t plan to) build in different rates of salary growth. Just wave the magic “real dollars” wand. Some fans of the big cities will quibble though that it’s not so much starting salaries that are higher, but that there’s more room to climb the ladder and get to a (much) higher salary with time.

Note: there is a way to parallelize the Google Sheets, so if you see more than ~4 people trying to edit it at once, let me know and I’ll get off my lazy butt and do that.

Questrade: use QPass 356624159378948

Questrade: use QPass 356624159378948 Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.

Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.