The DIY Investing Environment

October 6th, 2015 by PotatoHad a great chat on Because Money about who might be well-suited to being a DIY investor, what traits you might want to focus on as a DIY investor, etc., which should be airing later in October. I want to use this post to go down a side alley we didn’t talk much about in the episode.

Only ~13% of Canadians are DIY investors, and most of them started in the last 5 years. While we didn’t quite agree on precisely how many people should/could use a DIY approach, we were all giving estimates well above that figure. There’s a lot of room for improvement.

So what is stopping people from becoming DIY investors, what are the barriers? I like to think in terms of intrinsic and external factors.

For external factors, the environment has been getting a lot friendlier for individual DIY investors over the past few years: low-cost ETFs increase the cost savings available and make it very easy to create broadly diversified portfolios — whatever your position on efficient markets and index investing, it’s undeniably easier to implement than value or dividend or day-trading or whatever DIY strategy, which is part of why gurus like Warren Buffet recommend it for regular people. Brokerages like Questrade offering free purchases makes those ETFs accessible to investors with smaller starting portfolios, and even the bank-affiliated brokerages have extended $10 commissions to all customers without a net worth test. On the other end of the spectrum, Tangerine and the robo-advisors have made it very simple and easy to be a DIY investor — about as easy as a visit to the local bank branch salesperson/”advisor” was, at less than half the cost and without having to find a slushy parking spot in February.

The environment and the tools available to be DIY investors are quite good now — massive leaps ahead of what potential DIYers faced just a few decades ago.

So the remaining barriers are inside people’s heads. Not just their behaviour, but their biases and assumptions that are stopping them from starting, or even looking into whether they should start. Things like assuming you need to be rich before you think about investing, that you need to be a genius or use a lot of math, or get some kind of license or certification to purchase investments on your own.

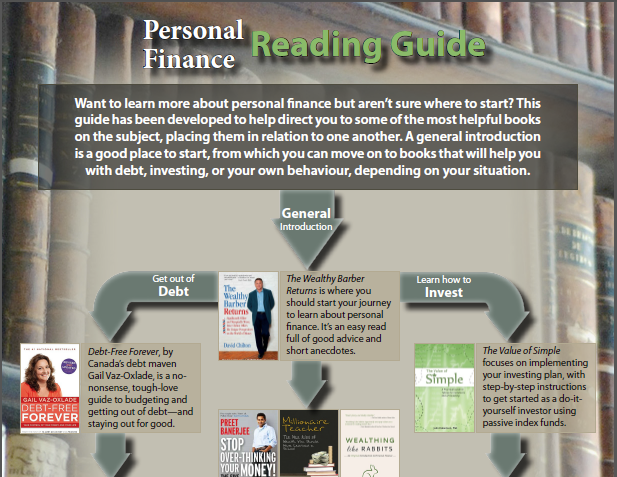

All of these are easily solvable with a bit of education. Of course I have my own solution for that in the form of The Value of Simple (plus this other thing that I’m working on).

And of course, doing DIY investing doesn’t mean you have to do everything on your own. You can find planners, accountants, coaches, etc. to help with any parts you’re not comfortable with.

So there are a great many people out there — maybe half of you reading this or more — who could move into doing DIY investing to save on fees, or get started with investing in the first place. So what are you waiting for?

As a side point to this side point, there was a bit of disagreement on what DIY is, and I’ll just say I’m not too worked up on the semantics either way. In particular, the question was raised as to whether using a roboadvisor or all-in-one fund with automatic rebalancing like Tangerine was really DIY? For myself, I would count them as part of the DIY route as they still require following your own plan, picking your own product (even if that product is just Tangerine premix #2) and not getting sold on the fund of the week, pushing money to your investments vs having a salesperson trying to pull, and above all, reaping the main benefit of DIY: lower costs.

Anyway, there are a few Because Money episodes from season 2 up now, and be sure to watch for my guest appearance comes out later this month.

Questrade: use QPass 356624159378948

Questrade: use QPass 356624159378948 Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.

Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.