I have so much to say about the last crazy, lunatic, unprecedented year, and not sure how to say any of it — my own thoughts are still all muddled. Covid was just a part of that for me — we’re also coming up on a year since my dad died. I haven’t properly eulogized him, or told his story Speaker for the Dead style, and don’t know if I will ever be able to.

This may be a personal blog, but a big focus is on finances so let’s stick to that aspect. It’s easier to talk about, at any rate.

Doing taxes was painful this year, for lots of reasons. I had to prepare the final return for him, as well as a T3 return for the estate, which had quite the learning curve and lots of weird CRA idiosyncrasies. Some examples to delay us before getting to the meat of the post? Sure, why not. Let’s start with where to simply mail the form. It wasn’t a simple Ontario and East send it here, Manitoba and West, send it there — Ontario was spit up with some cities sending it to one tax centre, others to another. Why does that matter? It’s not on its own a complex thing to figure out, but it’s one more step of complexity in what was already a hard process, and one that most people only face under hard circumstances. And it seems like the sort of thing that makes no damned difference so why is the CRA making it needlessly harder? Oh, and there was also one page that got sent on its own to another tax centre in Quebec. Why? Who knows.

It was painful because it was the “final†return and well, that’s a reminder that he’s dead, that’s it. Things are final now, and there are feelings there.

But the other reason tax season was painful was that I had to go over all the financial losses from 2020 to report capital losses. For most people, 2020 wasn’t such a big deal, investing-wise — scary for a brief while, insanely bubbly in a few pockets of the market, but a buy-and-hold index investor ended the year in the positive. Not so for us.

I’ve said many times before that my dad was a good investor. He got me into investing at a young age, etc. etc. That was an understatement: he was a great investor. He didn’t want to be famous, but would give his head a little shake whenever someone else tried to proclaim themselves “Canada’s Warren Buffettâ€. He was Canada’s Warren Buffett, or at least it seemed that way for a long time.

But as Buffett said, a long string of impressive numbers multiplied by a single zero is still a zero. In the end my dad wasn’t Canada’s Warren Buffett: he was Canada’s Bill Miller or Hwang.

The problem was that he was so good for so long that he got over-confident. He was not afraid of leverage — indeed, he used a lot of it.

On an episode of Because Money (I can’t remember which one to link it now), I shared the tale of how he was in the hospital, sick from his cancer, and needed to check in on the market — because a drop of 5% would be enough to trigger a margin call.

We argued a lot about leverage after that.

I tried to tell him that he was taking too much risk — risk he didn’t even need to take. He tried to convince me that if I ever wanted to be rich, to do more than just get by on my public sector salary (which he also argued I could do much better if I just switched careers), I needed to use leverage.

So he gave me a two-part gift: the first was an amount of money, which here we’ll just call X, a large amount that was roughly a year’s salary for me. The second half of the gift was that he would manage it for me, including by using margin. When I was young he had taught me to invest, but he never really taught me how to invest, at least not like he did. Dad was not the teaching type — he had no patience for it. So this was a chance to finally pass along that knowledge, as I could see what he did in an account in my name almost in real time.

X went into a brokerage account, and he borrowed another 2.48X against it. All it would take would be a 28% market correction to completely wipe me out, which was terrifying. “Relax,†he said, “you need to get used to this. If I do lose you your money, I’ll just write you another cheque. But it won’t happen, and this is something you have to learn.â€

Well, Covid-19 hit. I bought some puts on the S&P500 in the early days as a hedge — I briefly felt like a market genius when the virus escaped Wuhan and the market started to wake up to the risk. I sold those for a small profit as things got volatile and it reduced the margin a tad. But the market kept going down, violently. The overall markets were down about 30% by the end, but the highly concentrated active portfolio he was in was down even more, despite appearing more conservative. But all those staid dividend-payers suddenly looked like broken businesses in the wake of shutdowns, and the overall indexes were buoyed by tech stocks that we didn’t own. I threw more money from my savings at the account to try to stave off a margin call, but finally got margin called on March 22, and became a forced seller just a day before the bottom was in.

In the end, X became 0.1X — my inheritance was essentially gone. The market recovered over the rest of 2020, but I did not leverage back up, and even if I wanted to there are limits to how much I could have added.

That’s the real danger of leverage: even if you have the psychological risk tolerance to ride out a volatile period in the market, a big enough dip can cause a permanent loss of capital as you’re forced to sell at the bottom to cover the loan. I should perhaps interject that while that non-registered account was actively managed, I do have registered accounts that are invested in passive index funds, which fared much better though the market crash and recovery, and which is my general recommendation for people — obviously active investing entails various risks, doing so with leverage even moreso.

The story sadly doesn’t have a silver lining, as I also didn’t learn much about his style of active investing — the cancer made him tired, and a little extra motivation to teach didn’t magically imbue him with the patience for it. “So tell me son, why did I do that trade?â€

“I don’t know.â€

“Well if you’re too fucking stupid to see it then I guess this family is doomed.â€

“Thanks, Dad.â€

He wanted to spend what little energy he had left on trading, not teaching.

In addition to learning a lot about leverage — or rather, strongly reinforcing my previous view — I also got an object lesson in risk correlation. Because part of this whole experiment was a compromise that stemmed from those arguments on leverage: I would have an account with more leverage to get used to it and see first-hand its power, and he would in turn take down the level of leverage on his own portfolio. Because even setting aside how nuts it was to run so close to the red-line that a 5% correction would make you start blocking the margin clerk’s number in good times, it was not good times. He had by that point had several run-ins with the hospital system for his cancer, and many more days where he didn’t want to get out of bed to trade. So he agreed that he was going to reduce his own leverage, begrudgingly. But “reduce†didn’t mean “eliminate,†and he too was margin called, almost every damned day through March, 2020.

The ability of an insurer to pay out insurance that was also tied to that very risk — risk correlation is not a good scene. So very understandably, Dad had to renege on his promise to insulate me from losses related to the leverage. In hindsight that was a completely obvious outcome, but it somehow never occurred to me when I let him go nuts with margin loans in my account.

That whole year was crazy in so many ways, and I want to try to be clear (I know I’m not, but I’ll try) that the human losses were the real tragedy… but those are hard to talk about, and this is in many ways a personal finance blog, and there are financial aspects to talk about.

Another aspect of the whole affair was a huge whipsaw in my own financial planning.

Back before we found out my Dad had cancer, before we found out it had returned and spread, before we knew that it was terminal, we did a Because Money episode on expecting vs *expecting* an inheritance. Basically, I never factored in receiving an inheritance into my own financial plans, at least not in a major way. My parents were definitely better-off than I was, so my standard-of-living in part is facilitated by gifts from them. While they don’t pay my rent or anything quite that co-dependent, a lot of my luxuries have come from gifts: plane tickets for vacations, curling equipment, or new video game systems. A good portion of my clothes I didn’t buy myself. So of course I was leaning on them in some ways (hashtag privilege?) but I also wasn’t factoring an inheritance into my long-term plans.

Suddenly that was changing. I was getting a rather large gift up front, and dad was dying — the prospect of an inheritance was becoming very real and updating my planning to take it into account seemed like the next step. In-between arguments over leverage and trading strategies, we also argued about frugality. I’m a pretty frugal person by nature, and over 8 years of grad school only reinforced that. I save a decent portion of my earnings, and have nearly zero affinity for conspicuous consumption. Dad tried to convince me to spend more, and live more in the moment. He didn’t want me to save that gift for the future — he wanted to grow it briefly, then have me plan to spend the dividends on the extra gas and insurance for a new showy gas guzzler to replace my Prius. He wanted me to spend 100% of my income — I already had enough saved up for the first few years of retirement, and I could count on an inheritance after that.

I wasn’t willing to go that far (I mean, I love my Prius), but hey, I can get greedy too. I was off work to take care of him, but was already imagining what it would be like to spend a few extra thousand per year once I had a paycheque again. I had started *expecting* an inheritance.

Then Covid hit and we got to be on a first-name basis with the margin clerk and it all went to hell. Whipsaw: back to planning to save the normal way.

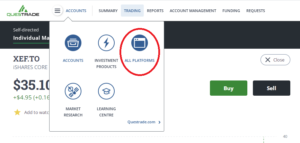

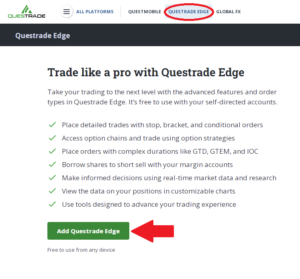

Questrade: use QPass 356624159378948

Questrade: use QPass 356624159378948 Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.

Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.