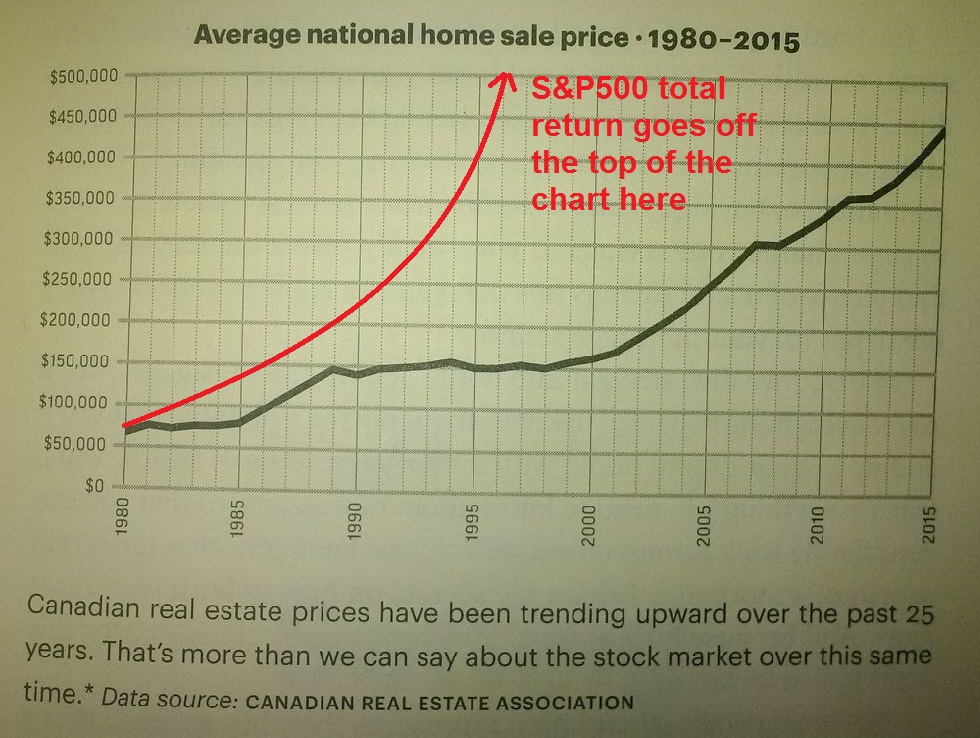

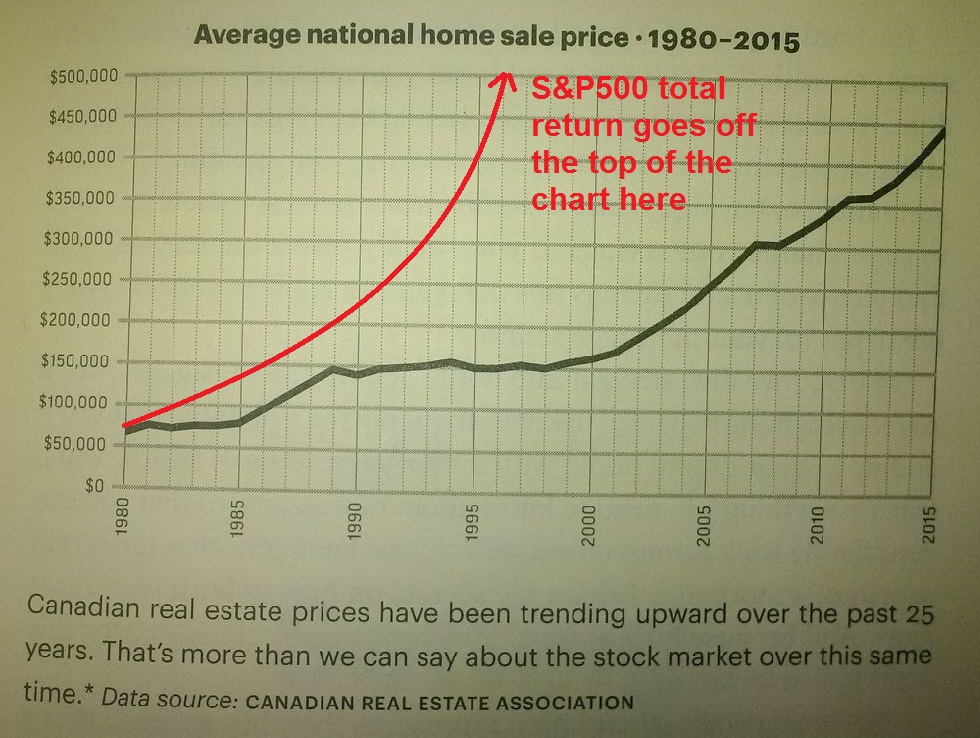

So this is going to be a review of Burn Your Mortgage, and TLDR, it’s mostly going to be me ranting and nitpicking so if you don’t want to get into that, just know that most of it is fine but there are some particular issues. This image sums it up:

Before getting to the book itself, some quick background on the tale. Sean is famous for buying a place, living in the basement, renting out the rest, and working super-hard to pay off the mortgage before he turned 31. The Sean Cooper Story boils down to: guy makes $150-200k/yr, lives cheaply in a basement apartment, saves up $500k over 7 years. Yawn. Oh wait, he didn’t just save and invest that money: he bought a house and then burned the mortgage. Now that’s a marketable story!

The biggest problem with Cooper’s story is that it happened at all. In the book and several articles, Sean has said that the reason he was so motivated to burn his mortgage was because of his mother and how she struggled to pay off the mortgage. He had a nearly irrational fear and distaste for debt.

So what should a debt-averse single person who is frugal and content living in a basement apartment do? Rent, of course! No, wait, I meant buy a house you don’t need! Then you can rent out the top floor while you live in the basement apartment, adding risk, losing your principal residence exemption, stressing about the mortgage and pouring everything into paying it off. I have referred to this as Cooper’s Folly.

Indeed, back when Sean first set off on the journey I pointed out that renting out the top floor of his house wasn’t as good a deal as he made it out to be — he was effectively paying something in the neighbourhood of $800-900/mo to live in a basement apartment based on the numbers he was publishing, which is what basement apartments cost anyway. In hindsight, the Toronto real estate market has been on fire, but because he didn’t stay crazy levered, he actually would have been wealthier if he had just rented a basement apartment, saved himself some stress and worry over debt and space heaters, and invested in a diversified portfolio (thanks to the markets also having a great 5-year run — over 12% annualized for an aggressive e-series portfolio vs ~9%/yr for Toronto real estate).

Anyway, this is just the background to the book: Sean bought a house, rented most of it out, lived frugally, worked an insane amount, and paid off the mortgage in 3 years (or, because the downpayment was also significant, the alternative title might be “local man works three jobs, lives in basement, saves $500k over 7 years.â€).

The first chapter relates that story, and talks generally about buying a house, while barely even analyzing whether anyone should be buying a house or if renting might be better in their situation. Where it does touch on the topic, it does an egregiously bad job of it, so if you happen to know something about how to compare the options it comes across as extremely biased towards buying. The figure above says volumes about the dismissive tone towards renting and investing. He takes a dig at bears (throwing shade at Garth Turner in particular), but then sets up a strawman version of the rent-and-invest thesis to then make a show of toppling. Sean ignores interest in the rent-vs-buy comparison (implying it’s insignificant), then on the same page says that mortgage interest is a compelling reason to pay down your mortgage (implying it’s an important factor). Within a few pages he talks about the power of leverage as a reason to buy over renting (indeed, 2 of his 8 pros to buying relate to leverage)… then excoriates the reader to not use leverage and burn the mortgage.

After that, the rest of the first section is generic advice on frugality, with a lot of lists… Most of it is fine, but parts of it read weirdly. To take one particular example, he suggests that you could save $500/yr on gas by planning your trips better and driving more efficiently. I spent $400 total on gas last year. Yes, I don’t drive much and have a pretty efficient car, but even with a normal car getting 10 L/100 km, that would take about 4500 km/yr of “extra trips†to get that kind of savings — it really just isn’t realistic. Similarly, who spends $1000/yr on taxis (actually, more than that, if they can save $1000/yr by cutting back or splitting with friends)? A lot of what he talks about in the frugality tips are outside his expertise and it shows.

Weirdly enough, there’s only ~4 pages on work ethic and time management. This really could have been almost the whole book, as the side hustle thing is a huge part of how Sean did what he did and is within his circle of competence to talk about. In some of his better times, Sean made more in a month (on top of his regular job!) than I made in a year as a grad student.

Let’s not understate this: he’s a very hard-working guy. He worked 80+ hr weeks for years at a time — not just a few months holding the world together while his wife was sick or ahead of a major deadline. And he kept that grind up without burning out.

Part of why I didn’t like the book is because of the massive missed opportunity there — I kept expecting to hear how I could also burn my hypothetical mortgage by hustling to earn more than my day job income, and how to fit all those hours in a day and avoid burning out. But the formula for success remains a secret. There is a side hustle appendix at the end, but it’s almost an insult, full of vacuous tips like “Childcare: Look after other people’s kids.†Yes, that is seriously the entire tip. He also suggests donating plasma for money, but there are only two clinics in Canada that do that (Moncton and Saskatoon), and Canadian Blood Services does not and will not pay for donations (though Wayfare is only alive because of the work of ~200 blood/plasma donors, so please do that one anyway). The rest of the list serves similarly as a brainstorming session with no regard to practicality — and clearly isn’t the way that he did it.

Anyway, from the generic middle we come to the FOMO section:

“Although foreign buyers help prop up the economy, many locals are finding themselves being priced out of the market. It’s probably wise, if you’re in the financial position to do so, to buy now while you can still afford to.â€

Yep. He also suggests turning to the bank of Mom & Dad, so they can tap a HELOC on their house to help you buy one. Or buy with a friend (“great way to build equity and get your foot in the door†— BTW there will not be a giveaway as I threw up on my copy).

Only late in the chapter, after fanning the FOMO, does he include a note of temperance: “Buying a home is a good long-term investment — most of the time. But it doesn’t always make good sense. (With a book title like Burn Your Mortgage, I bet you weren’t expecting me to say that.) In fact, you may jeopardize your financial freedom if you buy a home before you’re ready and end up selling it within a year, say.†I for one, could have done with a lot more temperance.

The book pays a fair bit of lip service to buying what you can afford and staying within your budget, so it seems like a huge gaping hole that it’s not until much later that he does actually provide a rule-of-thumb on what affordable means. Though that gets immediately undercut because after introducing the figure for affordable, he says to spend more in a pricey market (no justification on how that’s still affordable, or why you couldn’t spend more of your income in a less hot market).

There’s actually a lot of detailed information after that on buying a house, features of a mortgage, and getting wills and insurance, and there’s a lot of promise here… except the FOMO stuff makes it hard to recommend. Not just on getting in before being priced out, but things that are very Toronto/Vancouver red-hot market centric like going in with a “clean†offer, or a bully offer for good measure.

Here’s where I want to take a bit of a side-bar discussion: this is a dumb thing to do. If you actually need financing to close, then you have to including a financing condition, because if for whatever reason you can’t get a loan (which could be due to an unforeseeable event like changes to mortgage regulations or a weak appraisal), you can’t close and are liable for damages that can be costly without that condition as an out.

Realtors put a positive spin on this and call it a “clean†offer, but you might as well call it a “naked†one (and that gets into another sidebar about the incentive to make a deal happen vs. protect a client). Now, in a flaming hot real estate market (such as Toronto has seen up until recently), those are the lengths buyers have been driven to. So if you want to give advice to people that helps them “win†a bidding war and get a house, you have to be pragmatic with the prevailing conditions and suggest they put in a naked offer. And that’s one approach and I get that and it’s fine — but it should also come with the appropriate warning label, and at the very least acknowledge that most readers in the country are not facing such dire competition and can proceed with more sense.

The other approach is to try to give people unpopular advice to protect them, in which case you can acknowledge that the stupid thing is happening, and tell people not to do it. It’s a small risk, sure: most deals close and the buyer finds a way to finance; most pre-construction purchases end with the market flat or higher and a buyer is able to get a mortgage and close. But in a book that also suggests buying life insurance for young healthy people, this is a comparable risk and deserves similar discussion. As a bestseller, it could have helped turn the tide on foolishness. Besides, in markets where you “have†to go in with a naked offer and completely expose yourself to the risks of not being able to close, the price-to-rent might favour renting anyway.

Conclusion

Burn Your Mortgage is mostly harmless. The lead-in ignores the alternatives and serious risks involved in buying, it has a strong pro-buying bias throughout, and there are better sources to go to for frugality hacks, budgeting advice, and side hustle tips. But if you’re going to buy a house anyway, the middle section does have a fair bit of handy information on what’s involved in the purchase and financing process. To be fair I’ve focused on nit-picking the other sections, so the truly helpful middle chunk is not reviewed in detail.

Footnote:

And just as this post was being put up, this from the Star: “Others, who bought unconditionally, have discovered they can’t get the financing to meet their purchase obligation. In some cases, the bank appraisal has come in at a value below what a purchaser agreed to pay, leaving the buyer scrambling to make up the difference.”

Questrade: use QPass 356624159378948

Questrade: use QPass 356624159378948 Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.

Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.