Robo-advisors

November 20th, 2014 by PotatoI haven’t talked about the new wave of robo-advisors in large part because I’ve been neck-deep in book stuff, but now that Sandi has her excellent post up, let’s get into it.

Important book notice: there’s less than a week* left to go to pre-order and get free shipping or a special price on the ebook! Read more about the book here.

Not so long ago an article came out by Dan B/CCP concluding that robo-advisors were impossible in Canada. I took it as a challenge and started sketching out the plans for one and lining up programmers to make it happen — but then almost immediately sat back down to focus on the book first (which I was hoping would be successful enough to provide the risk capital to build the Canadian robo-advisor**).

It appears as though I’m not the only one who took the article as a call to arms, as less than 6 months later the robo-advisor invasion began.

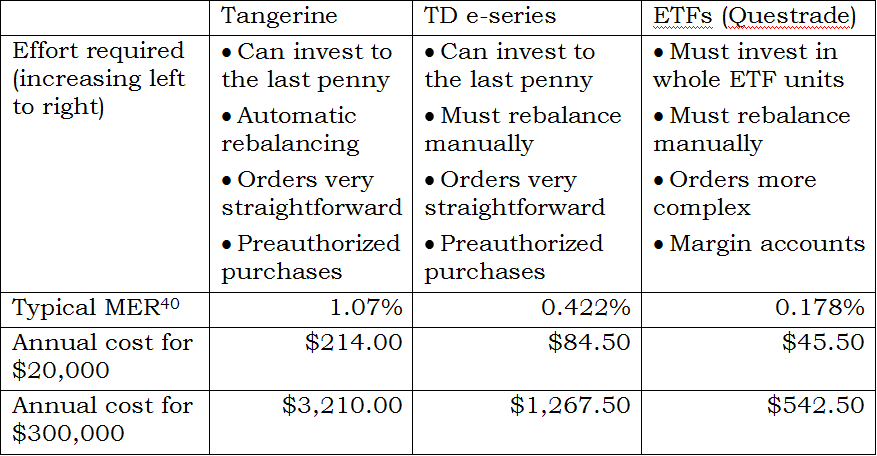

It is a very cool concept: for less than the cost of a full advisor you can get access to a passive portfolio that will be automatically rebalanced: low-cost passive investing with the convenience of throwing cheques at your mutual fund salesman. As Sandi points out, not everyone is prepared or cut out to be a DIY investor, so some intermediate-fee, intermediate-service options are very welcome.

I do have a few concerns, however:

- These are almost all new companies.

- They launched within weeks of each other (or, inconveniently, within days of building the comparison spreadsheet).

Combine those two and I have some doubts that they will all still be here 5 years from now***. There are only a few discount brokerages in Canada: those with the big 6 banks, Questrade, Qtrade, and Canadian versions of multinationals (HSBC, VB, IB). That could be because of oligolopistic collusion, or because it takes some scale to survive. I’m not sure ~4 new players will survive — though if they do it will likely be because of a large shift away from high-cost funds, which will be welcome. And given how closely they launched, I have fears that at least a few of the offerings rushed to market not fully formed (though no reports yet of any problems so maybe all is copacetic).

On top of that is the challenge of deciding which one to go with: the fee schedules are like a tax return, with marginal rates and a dependence on which province you live in. Oh, and what exactly you invest in as the fees for the underlying funds are often on top of the headline price, and those vary with your risk tolerance choices. Yes, that helps them keep costs as low as possible, but means Sandi had to make a complicated spreadsheet just to compare the offerings. I have concerns that the complication and multiple layers of fees could turn people off.

Finally, they just aren’t that cheap. Yes, they’re head-and-shoulders better than a high-cost actively managed bank fund, but they can’t even match TD e-series on fees. If TD ever decides to open e-series to their salesforce then these guys could be in trouble. For some people, these offerings will be well worth it (and again, Sandi makes that point much better), with costs well below that of a high-fee mutual fund salescritter and possibly equivalent service. For others, saving a few hundred or even thousands of bucks a year will be worth going the DIY route and investing directly in the same ETFs these services use****.

Which of course brings me back around to The Value of Simple — the how-to guide to for all this ETF and investing stuff. You should at least read it so you know what you’re paying your robo-advisor (or human advisor) to do for you.

* – Why less than a week when the book doesn’t come out for almost two? Because it normally takes a few business days to ship, so if you order after ~Nov 26 it wouldn’t arrive until after Dec 1st anyway.

** – Also, all of the programmers/developers I knew were too busy doing something to try to improve cancer care and research. Priorities, I tell ya.

*** – Not to engage in fear-mongering. There’s no reason to suspect that any of them are on shaky footing, just talking about general competitive pressures. Also, your underlying holdings will be fine even if one does go under or get absorbed — the worst-case is more likely inconvenience and a triggering of capital gains in a non-registered account if funds have to be liquidated and converted to the new custodian’s nearly equivalent offerings.

**** – Of course, I come from the bias that DIY is not so hard and not so scary and lots of people could be doing it. If you’re stuck on the other side of the fence, then a robo-advisor is a much smaller hop from a “full”-service advisor.

Questrade: use QPass 356624159378948

Questrade: use QPass 356624159378948 Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.

Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.