Value of Simple RRSP Series Part 2: Deferring the Deduction

February 14th, 2015 by PotatoPutting money into your tax-sheltered accounts (RRSP, TFSA) is great: not only are the gains on your investments not taxed, tracking the gains and distributions becomes totally optional because the CRA does it for you (or more properly doesn’t care, and treats it like a black box where only what goes in and comes out matters).

While using your TFSA right away can be a good move for almost everyone, the RRSP can be trickier: if you’re young and not making much now, you may want to wait until you are closer to your peak earnings (or at least a few tax brackets higher) before you start contributing and taking the deductions. You can of course hold on to your contribution room — it will carry forward until you’re ready to use it.

However, a neat feature is that the contribution and taking the deduction are separate steps: you can contribute to your RRSP to get tax-free compounding and a freedom from paperwork and hold on to the tax deduction until a higher-income year. I did this towards the end of grad school, maxing out my meager RRSP room while deferring the deduction until last year when I was working full time. Indeed, this is one of the classic examples of where such a move is the way to go. Another case where you may want to defer taking your deduction is when you have a new job or big raise that starts partway through the year, and won’t hit that next tax bracket until the year after.

When should you consider deferring the deduction? [edit: please see the next post for when deferring might make sense.] I don’t have a precise formula or spreadsheet ready for you. You do need to consider the time value of money: a tax deduction (refund) now will be more valuable than one a few years from now. There should be a reasonable chance of getting to a higher bracket soon — and the bigger the projected shift the more you may be willing to wait. Waiting 3-4 years to move from a 20% tax bracket to a 31% one was a no-brainer for me — the tax refund was worth 50% more in just a few years. Deferring for a decade in the hope you’ll move from 31% to 33% or 35% may not make sense for you. If you still have TFSA room, use that first — you can always pull from your TFSA to contribute to an RRSP later. But if your TFSA is full and you’re starting to build non-registered investments while you wait for your salary to increase to use your RRSP room, then contributing and deferring may make sense.

I’ll just note that some cases make sense for deferral (like mine in grad school), but for many people out there in the middle class, the climb through the tax brackets is gradual enough that it usually will not make sense to defer taking the deductions — if you’re not sure, you’re probably one of the many who will be just as well off taking the deduction immediately.

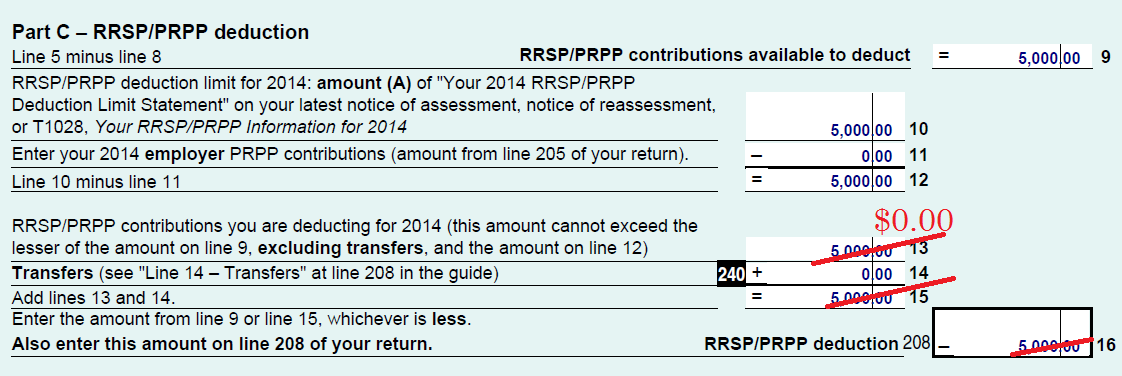

How do you engage in this magical deferral? The contribution step is the same as always: move money into your RRSP (and once it’s in there, invest in something). You’ll get a contribution receipt, which you will report on your taxes — even if you plan to defer taking the deduction you must report the contribution, and you must have enough RRSP contribution room for it. Your tax software will likely then try to automatically use all of your contributions for deductions right away to maximize your current refund. If instead you want to defer them, search for a form called Schedule 7. If you follow along in the PDF/paper version of the form, it’s divided into parts:

-

Part A — Contributions

Part B — Repayments under the HBP and the LLP

Part C — RRSP/PRPP deduction

Part D — RRSP/PRPP unused contributions available to carry forward

Part C is where the magic happens: you just tell the CRA how much of your contributions you want to use for a deduction this year. If you contributed $5000, but want to carry-forward that whole amount, just override line 13 with $0 (you want to use none now). Or you can enter a partial amount if you want to use some now and some later (useful if you’re just over a marginal tax bracket break).

To do this in TurboTax, click on the forms button at the bottom of the screen, and then the “form lookup” option. Start typing “schedule 7” and you’ll see it pop up. Once you open it, it will look almost identical to the CRA form above. If you try to change line 13, it will take you to a special TurboTax “worksheet” where you can enter the amount you want to carry-forward, which saves you a step of subtraction. Note that you can also go directly to the worksheet from form lookup (just look for “RRSP”), but it makes more sense to me to look for schedule 7 than some special TurboTax thing.

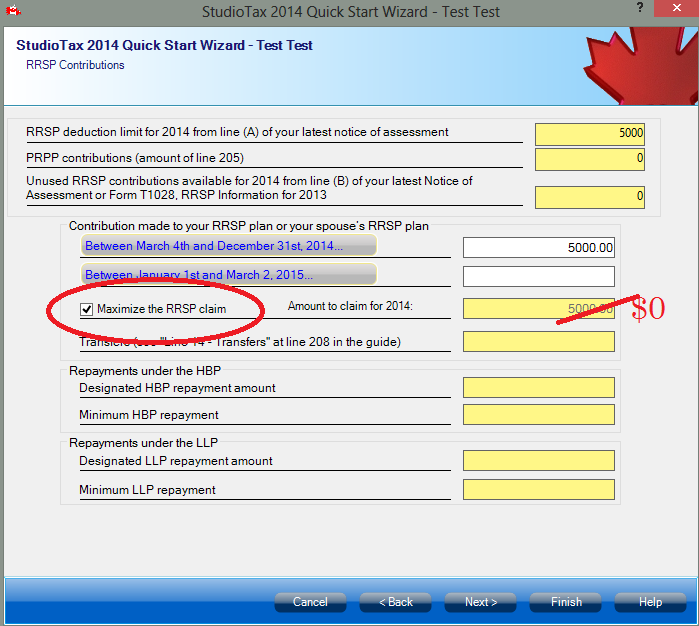

In StudioTax, you can adjust this right from the initial wizard when you’re entering your RRSP contribution information: uncheck the “maximize RRSP claim” option. I’m a little less familiar with Studiotax, but it appears that if you want to defer your deduction after you’re past this wizard step, you have to click on “forms” at the top to ensure Schedule 7 is in the “added forms” category, then click on “federal forms” at the bottom of the screen. Double-clicking on line 13 will bring the wizard screen below back up so you can adjust how much you want to claim this year.

Once you’ve deferred your deduction, you’ll see it show up on your notice of assessment. If you use the same tax software year to year, it will pull that deferral forward for you next year; if not, you’ll have to enter it from your notice of assessment, and you’ll see it show up in the very first line of Schedule 7 as unused RRSP contributions. Every year your tax software will try to automatically use your deferred contributions and any new contributions for you, so if you’re trying to defer for more than a year then you’ll have to make the adjustment to line 13 each year until you’re ready to take it.

Questrade: use QPass 356624159378948

Questrade: use QPass 356624159378948 Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.

Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.

February 16th, 2015 at 5:20 am

[…] Holy Potato gives a great walkthrough of how to defer your RRSP tax deduction to another year. That’s a useful tactic if you’re pretty sure you’re going to make more money in the future but have RRSP room now. […]