Advice and The New Model

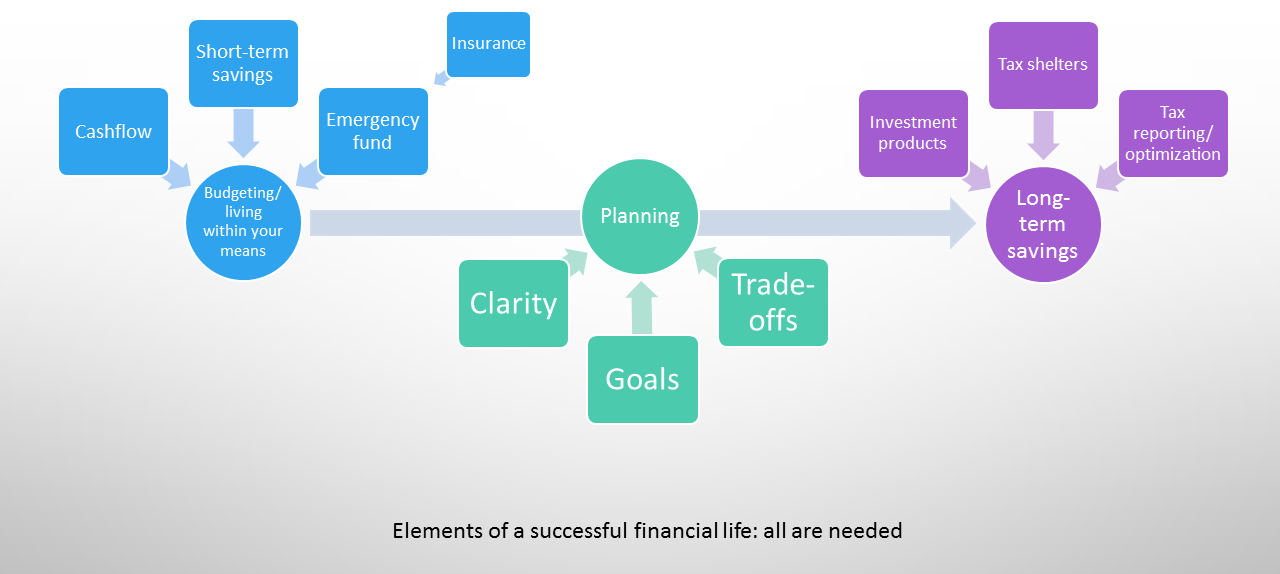

February 25th, 2017 by PotatoThere are many elements to a successful financial life. You’ve got to live within (below) your means, which means developing an ability to budget and deal with cash flow. Create some savings and disaster-proof your life. Then come up with a long-term plan, and get some investments going to make it happen. So a successful financial life looks something like this:

These are all important. How they get done though is different for everyone. Some people find that things comes more-or-less automatically. Other people need help to sort out some or all of this. For example, budgeting and matching up cashflows is really intuitive for me, I barely needed to read anything before I was off handling it on my own, whereas some people need help from a money coach to sort out their budgeting, cash flow, and basic relationship with money.

And at various points, you may need help with something. There’s no shame in that, we’re not all personal finance bloggers obsessing over this stuff, or people with the time to read books and take courses to try to build up the skills to DIY.

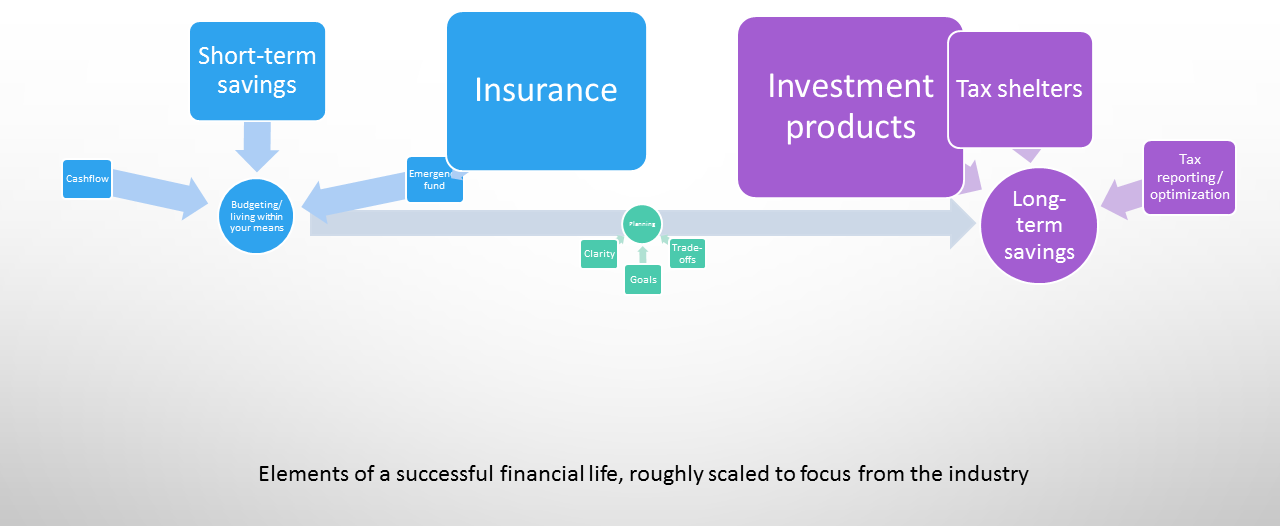

But when you go to look for help, a successful financial life may look more like this:

Traditionally, many advisors only made money if they sold you a product of some sort, especially investments (mutual funds, etc.). So their view of your situation was focused in on that part of the problem they could solve. Planning became less about clarity, goals, and trade-offs than about coming up with a bare framework to support investment purchases.

And that’s not to mention the conflicts-of-interest, such as that some advisors might not even ask you about your debt or budget, and look to invest any cash you have, even if paying off your debt may be a better use for the money. Or that so much of the focus is on investment selection (i.e., active management), which is where you will get little to no value for your money.

Advice — good advice — can be extremely valuable. Lousy advice — distressingly common — can be extremely expensive. If you’re paying your advisor through commissions on mutual funds that you buy, and you’re getting good service and value for those fees, then that’s totally fine. But I don’t see that being the case all that often, and those high fees really eat away at your long-term worth.

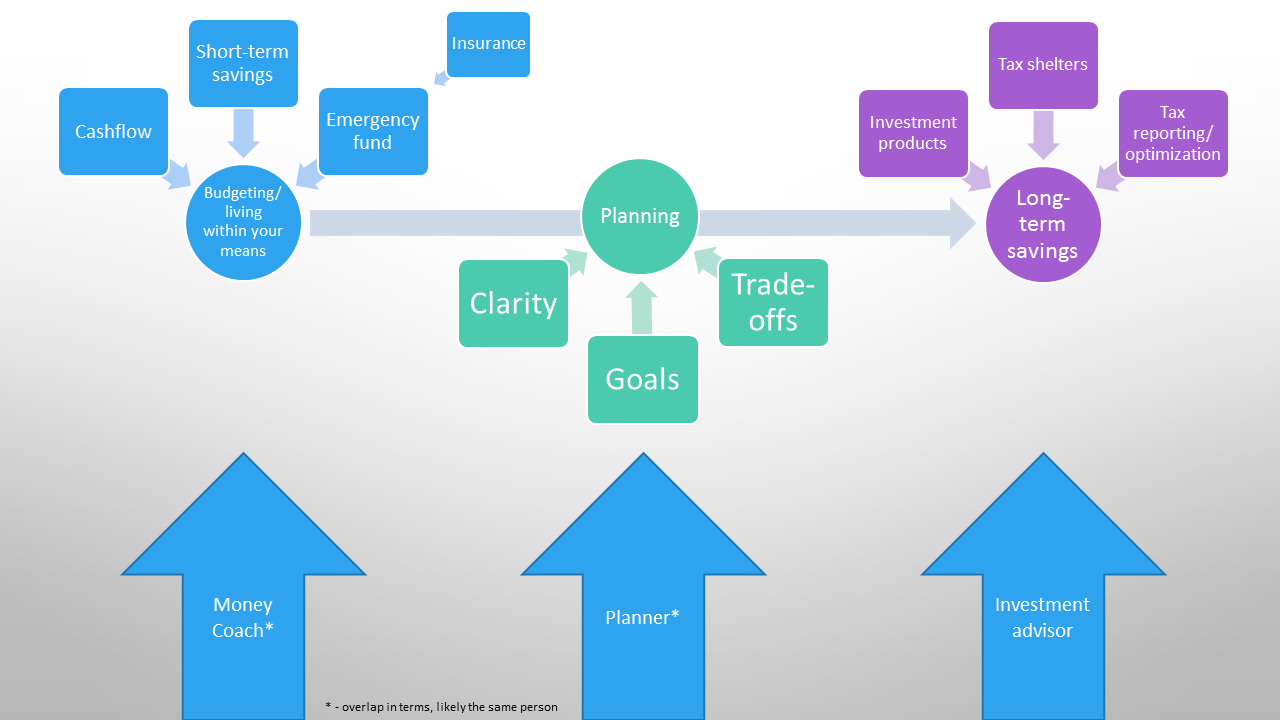

Instead, a new model is emerging that I like a lot better: paying for advice in a transparent way, for any part of your life that needs it, then figuring out the products to fit that advice separately, whether through DIY investing in low-cost index funds or using a robo-advisor to handle the investment management part.

In addition to getting value for your money and having transparency, this model lets you put the focus where you need it. If you need a money coach to help you sort out your cashflow and budgeting, you can now find one fairly easily — it’s not a side discussion you cram in while shopping for insurance or mutual funds. If you need to talk more about planning and clarity to figure out what direction your life is going in and how you meet your goals, you can do that.

Do you have confidence in your plan? Wait, that’s backwards: does your plan help inspire confidence in you and where you’re going? It doesn’t have to be a 30-page printed report: a good sketch on a napkin can be really illuminating. But if your plan is really just a few “know your client” bullet points to support some sales goals, you may want to work to figure it out yourself, or find a planner to help get that clarity.

So roughly speaking, here’s how I see the industry in the near future:

Each part that makes your financial life tick, you can find some support to help. From a full-service coach/planner/advisor, to semi-automated solutions and support for DIY methods. And for each of those, you’ll pay a transparent fee so you’ll know if you’re getting value for your money.

And this is already happening. Nest Wealth, Wealthsimple, and ModernAdvisor each offer planner dashboards, to allow collaboration with unlicensed (which here means not-salespeople) planners. The planner does the planning and coaching, the robo-advisor does the investment planning, and each can charge for their component of it independently.

For people with larger portfolios, this new model is likely going to lead to better advice at a lower cost. For people with smaller portfolios who are just starting out, paying an hourly rate may cost more than they’d pay even with super-high 3% MERs… however, many people aren’t getting the planning support they want or need anyway, and this way they can get help with the elements that may be more important to them at that life stage, like figuring out their budgeting, or coming to an understanding of what their money is for.

Resources to do this:

Directory of Fee-Only [Fee-for-Service] Planners

Our robo-advisor comparison tool to find a robo-advisor that fits your needs and situation

My course on DIY investing to learn how to do the investment management part yourself

A reading list to help you get started

Plus loads of other resources out there for financial literacy. Chris at Rags to Reasonable has a free email course on getting a handle on your money (left side of the figure). Cait Flanders has her budgeting system. Bridget Casey has her build a budget course. And all the blogs.

Questrade: use QPass 356624159378948

Questrade: use QPass 356624159378948 Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.

Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.

March 2nd, 2017 at 8:56 pm

[…] Potato wrote about planning before purchases. Â I agree with him and have mentioned as much many times on this site. Unfortunately most of the […]

March 3rd, 2017 at 8:35 am

Love this post. So true!

I’m hoping in the (near) future that advisers can be completely independent. Like not having ‘your’ custodian.

Clients could have accounts/products anywhere and choose to work with any adviser via a standardized API.

Then the products could be evaluated objectively, with no bias for ‘what my custodian has to offer’.

I have a dream…