Investing Apps: Just Say No

January 26th, 2022 by PotatoPerhaps Commissions Aren’t So Bad

Dan Ariely talks about the difference between free and nearly free. Nearly free and free have basically the same effect on your overall net wealth: whether you pay 14 cents in ECN fees every month or zero as you accumulate your investments is going to have no measurable impact on your ability to retire. But the difference between a few cents and free on your trading behaviour is huge — people will trade a lot more when it’s free. Plus the sales commission on the selling side for Questrade is good for investor behaviour: not high enough to actually be a real barrier to selling, but puts just that little bit of psychological stop in before selling and prevents dabbling in day-trading.

So I’m worried these days that so many people don’t ask “what’s a good brokerage to use?” but “which investing app should I use? Is Robinhood in Canada?”

And as much as lower fees are better, perhaps there’s a behavioural benefit to paying a little bit of commission and we shouldn’t encourage zero-fee platforms. Plus these companies make money somehow, which may include providing worse fills (though that doesn’t seem to be allowed in Canada).

Smartphone Addiction

Your smartphone is an ingenious device, carrying more power than the desktop computer I had in university, and able to carry out many very useful functions. It’s no wonder many of us have them practically welded to us. But they are an insidious thing: they short-circuit our brains in some of the worst ways.

Paying by mobile phone reduces the pain of paying even beyond that of using a credit card, so it’s all too easy to impulse buy something and not even notice how much you spent with that tap. And so many apps are addictive (sometimes purposefully so) that just touching your mobile phone short-circuits all of your careful reasoning faculties. [only a modest exaggeration on my part]

Do. Not. Trade. On. Your. Phone.

Investing Apps

Long before there was daytrading involved, WealthSimple bragged about how a third of their users checked in with the app daily. Daily! For a robo-advisor. There’s nothing to do! The whole point is to have a long-term investment plan that you don’t have to babysit!

From their point of view it was great: more mindshare, better odds that someone is checking on their phone and a friend goes “oh hey what’s that.” So of course they loved it. But I was horrified. Setting aside the unhealthy relationship people had with their phone and this app, it was setting investors up for loss-aversion disappointment (or panic): the more often you check in on your portfolio, the more likely you are to catch a downturn and see that you’ve lost some money.

So mobile phone investing apps had a horrifying relationship to engagement and addiction before they threw day-trading into the mix.

Do. Not. Trade. On. Your. Phone.

Dark Patterns, Advertising, and Active Investing

The trailblazer in no-commission app-based trading, the brand that has become synonymous with the product itself, is Robinhood in the US. And Robinhood has been criticized for its dark patterns, gamifying parts of the user experience to encourage people to trade more often and make more speculative bets. For example, they’d flash digital confetti up on the screen as a kind of reward/congratulations for placing a trade, and list trendy stocks.

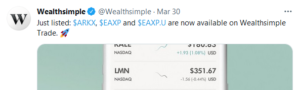

Now WSTrade looks to be copying some (but thankfully nowhere near all) parts of the playbook, with a mobile-only [update: mobile-first, as I took forever to publish this and got scooped in some ways and they now have a desktop web version] app, offering zero commissions and fractional shares. And they’ll give you a free stock, to really drive home that idea of trading individual stocks, with a lottery-like component (will your sign-up bonus be a penny stock or a really valuable share?).

They also moved beyond stocks into an even more speculative space with crypto trading. And while not a dark pattern within the app itself, their ads are highlighting all the new speculative investments you can trade with them (rather than focusing on the good parts, like that you can do long-term investing in an all-in-one ETF with no commissions — in fact I can’t say that I’ve seen a single ad along those lines).

In the US case at least, there are plenty of stories of people getting caught in things they don’t understand and losing lots of money — whether through mistakes, or through functionally a fully enabled gambling addiction. Thankfully, here in Canada investing apps don’t push users toward derivatives to add risk on top of daytrading, though they are moving toward “instant deposits” to wipe out any chance for cooling off periods and do include crypto. And the “first stock” promotion of “up to $4,500!” reinforces the gambling aspect of investing, and fractional share ownership promotes speculating in individual securities long before a user is ready for that.

And that’s not to mention fat-finger trades — how many typos have you made texting on that device?

Do. Not. Trade. On. Your. Phone.

Academic Research Backs Me Up

Two recent papers back up my instinctive refrain that you should not be trading on your phone.

First, Does Gamified Trading Stimulate Risk Taking? looks at the gamification aspect:

“We find that gamification “nudges” participants to take on more risk, particularly when trading high-volatility assets. The effect is stronger for inexperienced traders with lower financial literacy.”

You can read a more lay-friendly version here.

Their finding on the moderating influence of financial literacy gives me some hope. However, it also worries me, as people with low financial literacy are the ones now searching for “investing apps” rather than “best brokerage” – the term brokerage is almost entirely missing from new discussions on Reddit, for example, so the people using these apps are much more likely to be the low-finlit ones most susceptible to the gamification, gambling, ads, and dark patterns.

Next, Smart(Phone) Investing? A within Investor-Time Analysis of New Technologies and Trading Behavior looks at people’s behaviour when trading on their phone.

“we find that smartphones increase the purchase of riskier, lottery-type, non-diversifying assets, and of past winners and losers. […] following the launch of smartphone apps, investors are—if anything—more likely to purchase risky, lottery-type, and non-diversifying assets as well as chase winners and losers on non-smartphone platforms. […] We find evidence against investors offsetting these trades on other platforms and against digital nudges mechanically driving our results. Smartphone effects are neither transitory nor innocuous: assets purchased via smartphones deliver lower Sharpe ratios. Our findings caution against the indiscriminate use of smartphones as the key technology to increase access to financial markets.” [emphasis mine]

That reinforces my more instinctive view that even touching your phone short-circuits your self control thought: simply trading on your phone increases the likelihood of buying riskier things, and it infects your trading even off your phone. They also include a reference to another study on purchases, supporting the idea that smartphones reinforce system 1 thinking, where people ordered more unhealthy food on their mobile devices.

Conclusion

If you’re looking to start investing, do not look for a zero-commission “app”. Start by reading, and then open a brokerage account and only use your desktop/laptop to trade. Even if the brokerage you ultimately choose has a mobile app, don’t use it, as even occasional usage may change your appetite for lottery-like stocks. Controlling costs is important and a virtue, but zero costs changes our behaviour in ways that may be counter-productive. A few dollars here and there (or even $10 big bank commissions) are not going to derail your long-term plan, but may keep you from trading more than necessary. And finally:

Do. Not. Trade. On. Your. Phone.

Questrade: use QPass 356624159378948

Questrade: use QPass 356624159378948 Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.

Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.

January 26th, 2022 at 8:20 am

It’s tempting for me to think it’s obvious that it’s dumb to trade with some app on a phone, but there’s no reason why new investors should know this.

Decades ago, I remember being worried about trading on a computer. I was concerned that I would get some dumb idea in my head (perhaps with some beer in my brain), and I’d make some trades before I had a chance to think things through properly.

With phone apps, all we need to add is 24-hour trading and hiring away some of Facebook’s neuroscientists to guarantee disaster from impulsive choices.

January 27th, 2022 at 7:42 am

Yes, it’s like “what would I do to maximize the chance of an investor failing?” and they’re a few FB sludge specialists away from that purest form. Maybe add loyalty points for trading more often, or a streak counter for trading every day.

January 29th, 2022 at 3:56 pm

[…] Robertson takes a deep dive into free investing apps and concludes, “Do not trade on your […]

January 31st, 2022 at 8:27 am

I got yet another email in my inbox this morning offering a special deal to install some store’s mobile app on my phone. That made me think of a corollary: maybe being more impulsive also translates to shopping. There has to be a reason they all seem to be pushing so hard to get me to install their apps when they’re (obviously) already perfectly capable of advertising to my email…